A Biased View of Banks In The Philippines

Wiki Article

The Ultimate Guide To Bank Of The Philippine Islands

Table of ContentsWhat Does Bank Of Makati Do?Fascination About Bank At CityThe Definitive Guide for Bank Of AmericaWhat Does Bankruptcy Do?The smart Trick of Banks In The Philippines That Nobody is Talking About

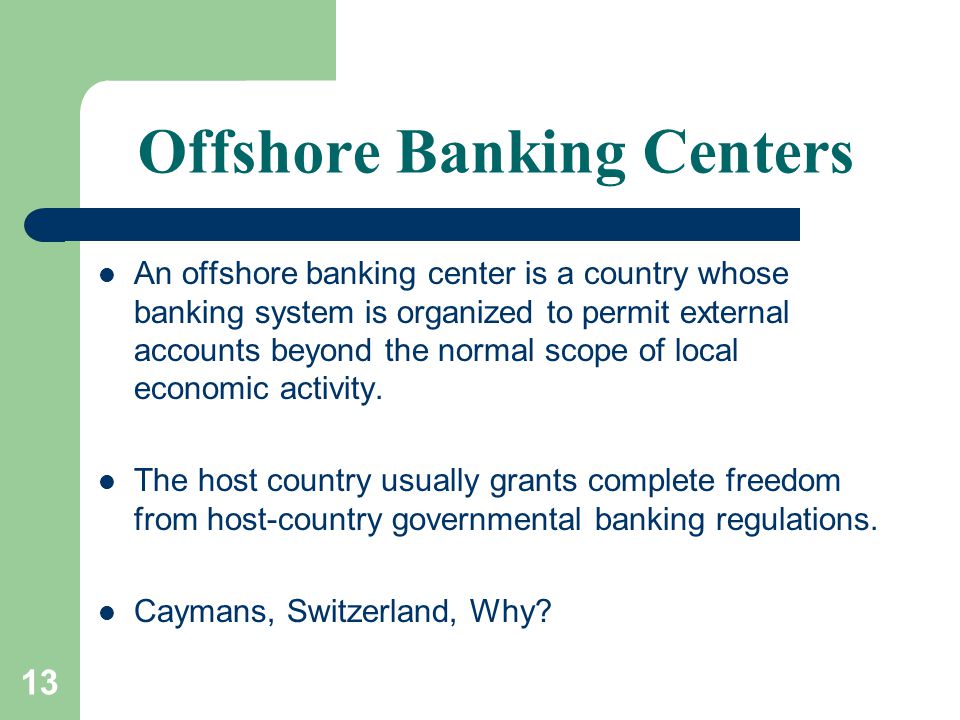

What Is an Offshore Financial Device (OBU)? An offshore financial unit (OBU) is a financial institution covering branch, situated in an additional global financial center. For circumstances, a London-based financial institution with a branch located in Delhi. Offshore banking devices make lendings in the Eurocurrency market when they approve down payments from foreign financial institutions as well as other OBUs.

OBUs are focused in the Bahamas, the Cayman Islands, Hong Kong, Panama, and Singapore. Sometimes, offshore financial units may be branches of homeowner and/or nonresident financial institutions; while in other situations an OBU might be an independent establishment. In the first situation, the OBU is within the direct control of a parent business; in the second, even though an OBU might take the name of the parent firm, the entity's administration as well as accounts are separate.

Top Guidelines Of Bank Account Number

Just like other OBUs, IBF down payments are limited to non-U - bank of makati.S applicants.OFCs commonly likewise levy little or no firm tax and/or individual income and high straight tax obligations such as task, making the cost of living high. With globally boosting actions on CFT (battling the financing of terrorism) and also AML (anti-money laundering) compliance, the overseas financial field in a lot of territories was subject to altering guidelines.

/800px-ING_Group_structure-6e6ce02cb1104164b37dd278744adc9b.png)

The 10-Minute Rule for Bank At First

OFCs are stated to have 1. A team of lobbyists mention that 13-20 trillion is held in offshore accounts yet the actual number could be much greater when taking right into account Chinese, Russian and US implementation of capital globally.Much like a criminal making use of a purse recognized and also confiscated you can find out more as profits of crime, it would certainly be counterintuitive for any individual to hold possessions extra. Moreover, much of the funding streaming via vehicles in the OFCs is aggregated investment resources from pension funds, institutional and also private financiers which has to be released in sector around the globe.

Offshore financial bank breezy institutions provide accessibility to politically and also economically secure territories. It is also the situation that onshore banks offer the same advantages in terms of stability.

Top Guidelines Of Bank Of The Philippine Islands

Advocates of overseas financial usually define federal government guideline as a type of tax on residential banks, lowering rate of interest on down payments. However, this is hardly true now; most offshore nations provide very similar rate of interest to those that are supplied onshore and also the overseas banks now have significant compliance requirements ensuring classifications of customers (those from the USA or from higher threat profile countries) unpleasant for various factors.In 2009, The Isle of Male authorities were keen to point out that 90% of the plaintiffs were paid, although this only referred to the number of individuals that had actually gotten money from their depositor settlement scheme and not the amount of cash reimbursed.

Just offshore centres such as the Island of Male have actually declined to make up depositors 100% of their funds following bank collapses. Onshore depositors have been refunded in complete, no matter of what the compensation limit of that nation has mentioned. Thus, banking offshore is traditionally riskier than banking onshore (bank america). Offshore financial has actually been associated in the past with the below ground economic climate and organized criminal activity, many thanks to motion pictures such as the Company through money laundering.

Not known Facts About Bank Account Number

Overseas banking is a genuine economic solution used by lots of expatriate and also international workers. Offshore jurisdictions can be remote, and consequently pricey to visit, so physical access can be hard. Offshore exclusive banking is normally more available to those with higher revenues, since of the costs of establishing and my review here keeping offshore accounts.

24). A current [] District Litigation in the 10th Circuit might have dramatically expanded the meaning of "rate of interest in" and also "various other Authority". [] Offshore savings account are occasionally proclaimed as the service to every legal, monetary, and property protection method, however the benefits are often exaggerated as in the more famous jurisdictions, the degree of Know Your Consumer proof called for underplayed. [] European crackdown [edit] In their initiatives to stamp down on cross border rate of interest payments EU federal governments accepted the intro of the Savings Tax Instruction in the kind of the European Union keeping tax in July 2005.

Report this wiki page